We believe that the driving force behind mobile adoption is consumer experience. The Rambus Unified Payment Platform enables merchants to integrate multiple forms of interactions with consumers to create a robust and powerful user experience.

What is the Rambus Unified Payment Platform?

The Rambus Unified Payment Platform is a comprehensive solution for retailers, merchant acquirers and banks that delivers enhanced security, reduced cost and increased revenue. The platform comprises four primary components: A Digital Value Manager, a Retail Wallet Engine, a white-label retail app and a set of optional modules to support credit/debit cards, gift cards, loyalty points and coupons.

The Rambus Unified Payment Platform also offers customers access to a set of optional and fully customizable modules. The modules enable retailers and merchant acquirers to easily and securely connect with third-party services, convert various types of digital value to a unified currency, as well as manage gift card, loyalty and coupon services in-house. Specific modules include:

- Credit/Debit Card: Allows retailers to add a credit or debit card, while connecting the scheme to a token gateway for secure access to digitize physical cards into a single wallet.

- Gift Card: Enables consumers to add or purchase gift cards, redeem gift cards, reload, provide balance inquiry and transfer value.

- Loyalty: Tracks new and existing loyalty cards, adds points on purchase, supports payment with points and adds bonus points to incentivize users to buy additional products.

- Coupons: Adds and redeems coupons, enabling retailers to push coupons to consumers in-store or within virtual carts.

Split payments, scan-and-go, and in-aisle check-out

The Rambus Unified Payment Platform offers a myriad of benefits for consumers, retailers and financial institutions. For retailers, the platform allows businesses to engage consumers with an immersive, in-app experience that starts when the shopper enters a store and continues well beyond the initial transaction.

More specifically, the Rambus Unified Payment Platform helps increase revenue (per user) by facilitating cross- or up-sell opportunities with integrated loyalty points and coupons. The Unified Payment Platform also provides direct access to detailed shopping data, allowing retailers, banks and merchant acquirers to offer a personalized shopping experience and effectively compete in a crowded marketplace. In addition, the Retail Wallet Engine enables in-aisle check-out options to lower overhead costs and reduce the number of required POS terminals in store.

For consumers, the Rambus Unified Payment Platform provides a convenient, “scan-and-go” frictionless commerce experience that seamlessly integrates payments, gift cards, loyalty rewards and coupons, as well as digitized receipts and transaction history of purchases, in a single retail app. For banks, mobile wallets, which are far more secure than credit or debit cards, have fast become a strategic focus as consumer interest ramps up.

Security

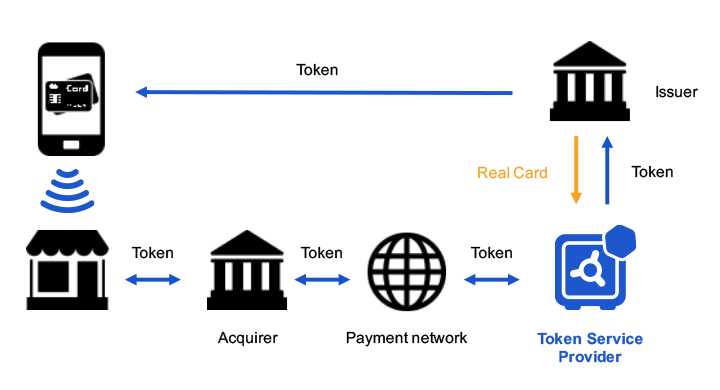

Consumers require assurances that their mobile payment information will remain secure. Similarly, stores and financial institutions need to be confident that the technology behind mobile payments is secure and easy-to-use before it can be truly embraced. This is precisely why the Rambus Unified Payment Platform utilizes tokenization to reduce the risk of fraudulent transactions by replacing key account information with temporary data. When a payment card is provisioned to a mobile wallet, the token service provider (TSP) tokenizes the primary account number (PAN) and stores the token in a smartphone.

The tokenized PAN is worthless if stolen, as it essentially acts as a reference for a consumer’s original card data which only the card networks and/or the consumer’s bank can map back to the original account. Any fraud attempt, or specific data breach, only impacts a specific token (or domain). It should also be noted that Rambus’ Unified Payment Platform allows banks to easily integrate multiple mobile payment schemes with a single software platform to manage tokenization activity across a range of ‘OEM Pay’ mobile wallets. The platform also effectively ensures banks are always in sync with the latest credit and debit platform requirements.

Interested in learning more about having your own mobile wallet? You can download the eBook below.