Juniper Research analysts are forecasting 1.4 billion 5G connections by 2025, an increase from just 1 million – upon commercial launch of 5th generation wireless systems – in 2019. Unsurprisingly, the U.S. alone is expected to account for over 30% of global 5G IoT connections by 2025, with the highest number of 5G connections for fixed wireless broadband and automotive services.

![]()

Although the projected 1.4 billion 5G connections by 2025 represents an average annual growth of 232%, Juniper analysts caution that 5G fixed wireless broadband will need to meet expectations in real-world scenarios to compete with fiber broadband.

“Operators and vendors must test their networks in a real-world environment at scale, ensuring speeds can compete with fiber services,” stated Juniper analyst Sam Barker. “Networks that can deliver the highest speeds and greatest reliability will command the highest ARPCs (average revenue per connection), hastening an operators’ return on 5G investment.”

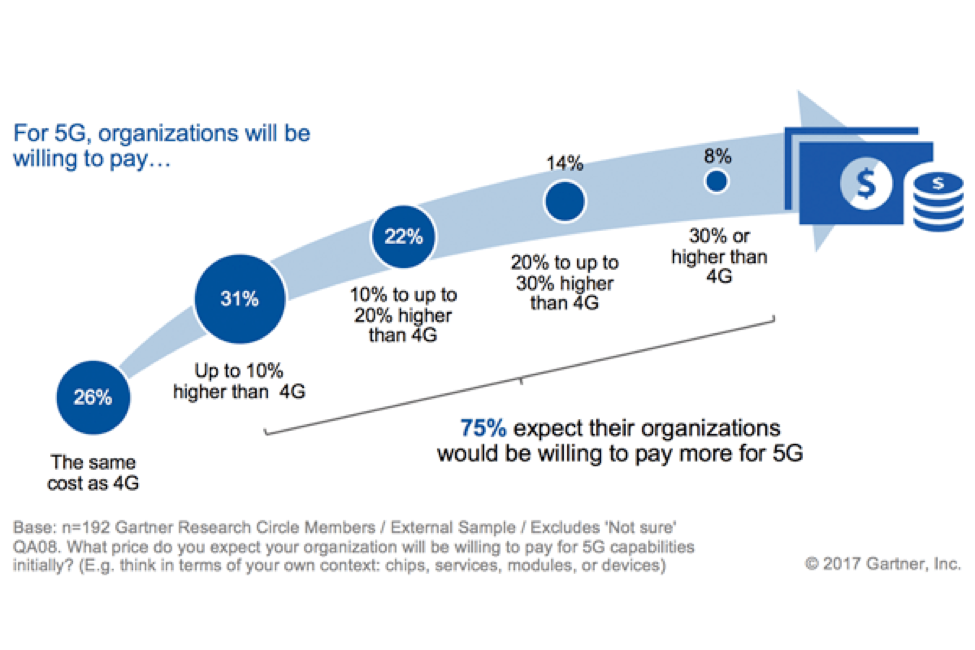

In other 5G news, an August 2017 end-user survey commissioned by Gartner found that 75% of end-user organizations would be willing to pay more for 5G mobile capabilities.

“Those in the telecom industry are more likely to be prepared to pay more than those in other industries,” said Sylvain Fabre, research director at Gartner, explained.

“End-user organizations in the manufacturing, services and government sectors, for example, are less likely to be willing to pay a premium for 5G than telecom companies, which are willing to pay a 5G premium for their internal use.”

The Gartner survey also determined that almost half of respondents intend to use 5G to access videos and fixed wireless capabilities. Moreover, the majority of respondents (57%) believe that their organization’s main intention is to use 5G to drive Internet of Things (IoT) communication.

“This finding is surprising, as the number of deployed ‘things’ that need cellular connectivity won’t exceed the capacity of existing cellular IoT technologies before 2023 in most regions,” Fabre continued. “And even once fully implemented, 5G will suit only a narrow subset of IoT use cases that require a combination of very high data rates and very low latency. In addition, 5G won’t be ready to support massive machine-type communications, or ultra-reliable and low-latency communications, until early 2020.”

According to Fabre, the above-mentioned finding may also indicate confusion over 5G’s applicability, as many proven and less expensive alternatives already exist for wireless IoT connectivity. For example, the use of Wi-Fi, ZigBee or Bluetooth would avoid the cost and complexity associated with cellular communications.

However, applications such as VR and AR are poised to be ideal applications for upcoming 5th generation (5G) mobile networks, as both will benefit from enhanced mobile broadband with its higher capacity, more uniform experience with consistently high data rates and lower latency.

“The AR and VR industry is thirsty for the capabilities 5G promises. It is a profound change in the way cellular networks have traditionally been developed: if you build it (the network), they will come (applications and users),” Qualcomm explained in a blog post earlier this year. “While we expect 5G to enable many new and unforeseen use cases, the enhanced capabilities of 5G are required for AR and VR to reach their full potential.”

As we’ve previously discussed on Rambus Press, the move from 4G to 5G is driving new architectures such as C-RAN, which further pushes SerDes requirements to communicate between remote radio head (RRH) and baseband unit (BBU) from 12G to as high as 48G. From a broader perspective, our increasingly connected world is prompting the semiconductor industry to implement and implement and innovate new architectures in the data center. These include DDR4 and DDR5 buffer chips, second-generation high bandwidth memory (HBM2) and hybrid DIMM technologies such as NVDIMM-P and NVDIMM-N.