A new study published by Juniper Research confirms that the global number of registered mobile domestic money transfer users is expected to reach 2.5 billion in 2018 – up from an estimated 1.7 billion in 2016.

Specific values are as follows:

- Domestic P2P: 65%

- Cash-in: 13%

- Cash-out: 11%

- Bulk disbursement (G2P): 8%

- Domestic airtime top-up: 2%

According to research author Nitin Bhas, the increase in mobile domestic money transfer users is currently being driven by a range of social media apps including WeChat and Facebook, as well as newer services such as Apple Pay Cash and Zelle Pay.

“It was inevitable that players such as Apple would follow in the footsteps of WeChat Pay and AliPay and offer a universal set of payment features integrating P2P, alongside existing contactless and ticketing functionalities,” Bhas stated.

Indeed, WeChat launched WeChat Pay in 2013 to allow peer-to-peer (P2P) transfers and in-app purchases on public accounts. Like AliPay, the service expanded beyond its original parameters, with shops creating physical QR codes that accept WeChat Pay as a form of payment.

As Bhas notes, 2018 will be the year for social payments, with key rollouts from Apple, Google and Facebook expected to drive the social payments market (a subsector of the wider mobile P2P market). However, Bhas clarifies that the uptake for Apple Pay Cash will be slow in the short-term due to a strong banking network in its launch markets. Nevertheless, the total number of annual transactions for the service is expected to near the 1 billion mark by 2020.

Concurrently, says Bhas, M-PESA, Orange Money and MTN Money will exceed 1 billion registered users by 2020 – thereby helping to drive financial inclusion for the unbanked in emerging markets.

“Operators are increasingly facilitating service interoperability, both at national and international level, thereby opening up the market for faster growth,” he added.

As we’ve previously discussed on Rambus Press, the recently published “Digital Banking Report’s Digital Payments and Mobile Wallets” report confirms that financial institutions are increasing investments in alternative payment solutions to improve the customer experience and support new solutions.

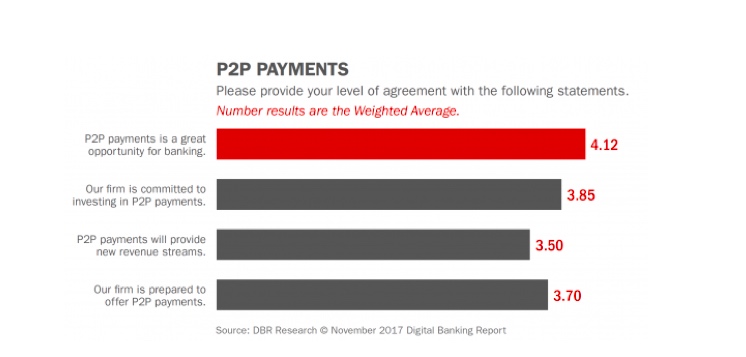

To be sure, financial institutions are focusing particularly on P2P payments, mobile wallets and debit cards, with the former two increasing in importance to other payment solutions. Moreover, most financial institutions polled in the report believe real-time payments and P2P will provide significant revenue and strategic opportunities in the future.

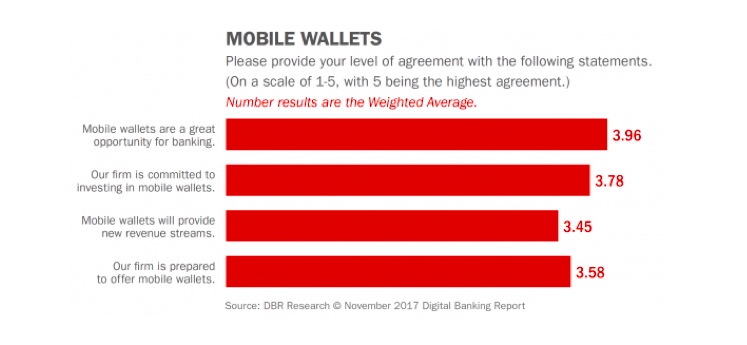

Meanwhile, the opportunity, commitment to development, preparedness and potential for revenue remains robust for mobile wallets, with the above-mentioned statistics reflecting the increased market pressures brought by financial and non-financial competition.