Rambus is boarding the blockchain bus with the unveiling of Vaultify Trade, a platform that enables the secure storage and transfer of cryptocurrencies and other digital assets using proven, bank-grade, field-deployed tokenization and encryption technology.

Payments Archive

Rambus Unveils Vaultify Trade for Secure Transaction and Storage of Crypto Assets on Blockchain

Deploys proven, bank-grade tokenization and encryption technologies for virtual assets

SUNNYVALE, Calif. and Las Vegas, NV – Oct. 22, 2018 – Ushering in a new level of security for blockchain implementations, Rambus Inc. (NASDAQ: RMBS), today announced the availability of Vaultify Trade. The platform enables the secure storage and transfer of crypto and digital assets using proven, bank-grade, field-deployed tokenization and encryption technology. Vaultify Trade is the first product that enables banks, exchanges and investment portals to leverage tokens to secure the purchase, storage, exchange and sale of cryptocurrencies.

451 Research Director, Jordan McKee explains: “While cryptocurrencies represent significant opportunities, a major risk factor is that they are prone to theft, in large part due to the lack of strong security solutions for the blockchain. This undermines consumer confidence and limits the ability for financial services companies to offer products that help comply with regulations and best practices. With additional trust and transparency, the potential for cryptocurrencies to transform financial services can be realized.”

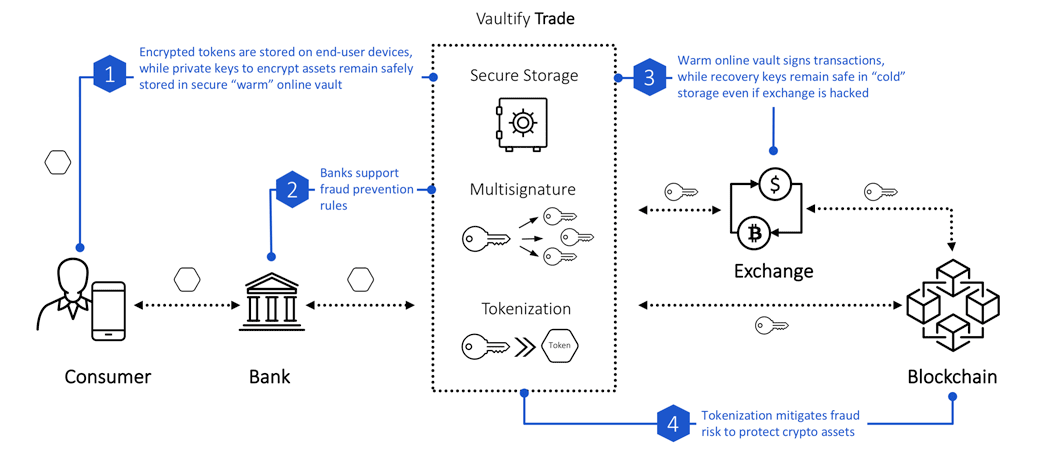

Blockchain is gaining increased traction across industries with the decentralized public-ledger framework opening new use cases daily, extending beyond cryptocurrency into financial services, retail, real estate, healthcare and insurance. While it provides a trusted and immutable record, the blockchain is not completely secure. Blockchain stores assets of value at an address in a public ledger using a private key. Much like a card or account number to access funds, that key is all that is required to access that digital asset, and if it is lost or stolen, that value is gone. Multi-signature enhances the level of security by introducing additional distributed keys for recovery and authentication of transactions, but still relies upon the use of original keys that are vulnerable to attack. Given the high-value financial and safety-critical nature of some proposed use cases, it is imperative that nothing alters data prior to its placement on the blockchain.

Tokenizing crypto assets and the blockchain

To meet this critical market gap, Rambus has created Vaultify Trade. Vaultify Trade combines multi-signature with proven, bank-grade tokenization technology to enhance security, confidentiality and privacy by replacing sensitive credentials—such as private keys for blockchain and crypto assets—with a non-sensitive equivalent token that is unique to each transaction. Unlike the private keys used to authorize blockchain transactions, tokens cannot be used by a third party to conduct transactions if intercepted. By replacing sensitive private keys with a limited use token that can include domain controls for device or channel, tokenization mitigates fraud risk and protects the underlying value of credentials. This reduces cryptocurrency security risks, which have led to enormous losses, adverse brand impact and suspensions of trading.

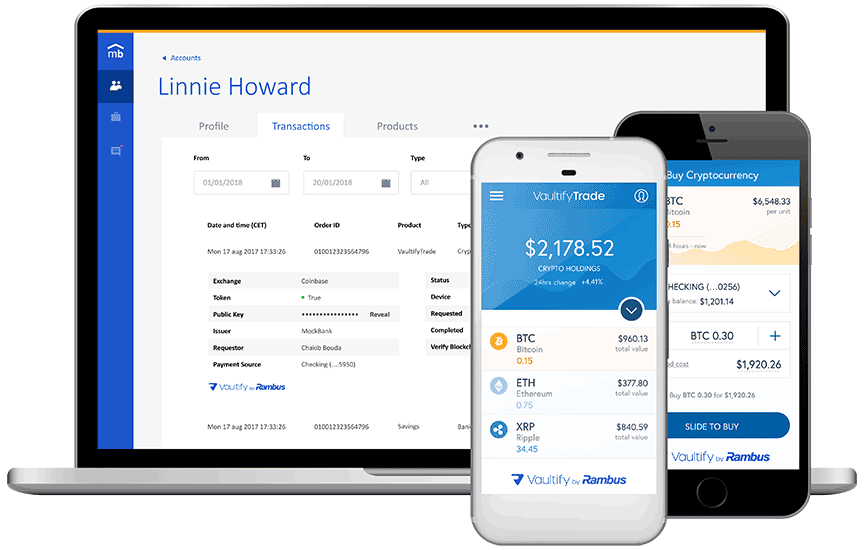

“Crypto assets are on the verge of going mainstream, but many of today’s consumers find cryptocurrency to be inaccessible and confusing, and are concerned by high-profile hacks. In order to accelerate adoption, consumers are seeking a secure, familiar way to access, trade, and own crypto assets through their trusted banking or trading apps,” said Jerome Nadel, GM of Payments and CMO, Rambus. “With over 100 billion transactions secured by Rambus technology, Vaultify Trade is a logical extension of our tokenization expertise. Banks, exchanges and investment houses can now quickly incorporate blockchain technologies into their product portfolios, armed with the confidence that data, value and assets are secure.”

Designed for virtual assets on the blockchain, Vaultify Trade features include:

- Tokenized Security – Replace sensitive private keys with domain-specific tokens to secure the transaction and storage of digital assets, limit vulnerabilities and improve trust.

- Multi-Signature – Multi-signature wallets require at least two signatures to confirm a transaction, increasing security and preventing fraud, while enabling faster transactions.

- Segregated Wallets – Combine the security benefits of an offline cold wallet with the convenience of an online wallet through multi-factor authenticated access to an online segregated wallet.

- White-label app and SDK – The Vaultify platform can support a white-label app or an SDK, allowing consumers to easily access and trade cryptocurrency through their usual mobile and desktop banking portals.

To learn more about how Vaultify Trade can help your organization, please visit www.rambus.com/vaultifytrade. Or, to see a demo of Vaultify Trade, please visit Rambus during Money 20/20 in Las Vegas at the Sands Expo Center in Booth #1349.

Rambus Token Gateway for E-Commerce Certified “Visa Ready”

Retail tokenization solution gives online merchants swift, seamless and secure access to the Visa Token Service

SUNNYVALE, Calif. – September 12, 2018 – Rambus Inc. (NASDAQ: RMBS) today announced that its Token Gateway for e-commerce solution is one of the first to be qualified under the “Visa Ready” for Tokenization program. This certified solution enables token requestors like online merchants, payment service providers and acquirers globally to quickly and securely connect to the Visa Token Service to tokenize card-on-file e-commerce transactions.

Tokenization is a security technology that uses a unique digital identifier, or token, to protect sensitive information like cardholder account details. By replacing sensitive account information with a limited use token, including domain controls for device or channel, tokenization mitigates fraud risk and protects the underlying value of credentials.

Benefits for merchants and consumers

The Rambus Token Gateway supports merchants in a number of ways:

- Customer convenience and confidence – Consumers no longer need to update card details following a card reissue, reducing frustration. Knowing that card details are not shared with merchants may also increase trust and the number of consumers willing to shop online safely and securely.

- Quick time to market – Merchants who integrate with Visa Token Service through Rambus do not need to wait for individual certification approval and can launch a token-on-file initiative more quickly.

- Reduced PCI compliancy – As merchants replace vulnerable cardholder payment data with secure tokens, their payment card industry (PCI) compliancy requirements may be reduced.

- Cost savings – The Rambus Token Gateway assures that merchants are constantly aligned with the latest Visa Token Service tokenization specifications, eliminating the need for manual integration work.

- Single interface – The Rambus Token Gateway provides a single interface to connect with all contracted token service providers, supporting a variety of messaging interfaces.

Proven technology for retail and e-commerce

451 Research Director, Jordan McKee notes, “The pace of digital change in financial services and retail is accelerating. We are witnessing a profound shift in consumers’ shopping preferences and habits, marked by a growing demand for omni-channel buying experiences. This is driving more transactions into digital channels and fraudsters are following the volume, eager to exploit vulnerabilities. Removing sensitive credentials from the transaction flow with a token is a critical defense that serves to safeguard consumers and revenues. Such steps ultimately improve the digital shopping experience and bring benefits to the entire ecosystem.”

“The success of the EMV® Chip Specifications in securing the physical point-of-sale means increasingly sophisticated criminals have shifted their attention towards more vulnerable e-commerce and m-commerce channels,” said Jerome Nadel, GM of Payments and CMO, Rambus. “Tokenization has been hugely successful in securing mobile payments and by using Token Gateway, we believe it can do the same job for online shopping. What’s more, increased customer confidence is likely to see higher conversion rates and reduce time spent chasing missed payments for merchants. As one of the first certified, we’re excited to support the retail community in managing customer data in faster and safer ways.”

Visit rambus.com/security/payments/token-gateway/ to learn more about the Rambus Token Gateway for e-commerce solution. Or, for additional information on Rambus products and solutions, please visit rambus.com/security/payments/.

ScotRail to introduce Rambus’ mobile ticketing solution

Scotland’s national rail operator ScotRail is to introduce Rambus’ mobile ticketing solution as part of a pilot scheme to support hassle-free travel. ScotRail customers will be able to use the all-in-one solution, HCE Ticket Wallet Service, to buy and download tickets with their smartphone.

Coles Selects Rambus to Revolutionise Retail in Australia

Platform secures omnichannel payments

SUNNYVALE, Calif. and MELBOURNE, Australia – July 24, 2018 – Rambus Inc. (NASDAQ: RMBS) a leader in digital security, semiconductor and IP products and services, today announced that Coles, one of Australia’s largest retail groups, has selected the Rambus Unified Payment Platform to securely power its Digital Payment Solutions.

Unified Payment Platform with bank-grade security enhances the customer buying journey

Rambus Unified Payment Platform provides both customers and retailers with a hassle-free, omnichannel payments service. The platform can digitise payments, gift cards, loyalty cards, coupons and receipts, and bring them into a single application that can be downloaded by customers and used on mobile devices. Omnichannel commerce allows retailers to marry online and in-store shopping, offering in-aisle checkout with multiple, convenient forms of payment. The platform consolidates this payment data into a single transaction, which can be made either in-store or online.

“We are looking forward to working with Coles to build their new digital payments solution in a very exciting time of change for the payments industry. We believe that our experience in providing card, mobile and account-based solutions for banks, financial institutions and retailers alike will allow us to bring the future of payments to Coles’ customers today through a trusted experience that is fun and easy,” said Jerome Nadel, SVP of Security Products and CMO, Rambus.

For more information on Rambus’ Unified Payment Platform solution, visit rambus.com/security/payments/unified-payment-platform. Or, to learn more about Rambus’ tokenisation solutions visit rambus.com/payments.

Rambus Makes Real-time Payments Safer with Payment Account Tokenization

Secures account-to-account transactions by removing sensitive information from the transaction process

SUNNYVALE, Calif. – May 9, 2018 – Rambus Inc. (NASDAQ: RMBS) today announced the launch of its Payment Account Tokenization solution to secure account-based transactions, such as automated clearing house (ACH) and real-time payments. The solution will enable central banks and clearing houses to replace sensitive account numbers with unique tokens and reduce the impact of fraud for transactions including direct credit, direct debit and person-to-person (P2P) payments.

Reduce account fraud through tokenization

Payment Account Tokenization secures account-based payments by replacing the valuable account credentials with a cryptographic token. This process significantly reduces the risk and impact of account-based fraud as the foundation of a safe and secure instant payments framework. When implemented by a centralized body, like a central bank, Payment Account Tokenization reduces fraud and enables key use cases like P2P, direct credit, and push payments in real-time.

“Tokenization has already been proven successful in securing mobile payments worldwide. Our Payment Account Tokenization does the same for real-time payments, enabling account-based transactions to be processed faster and safer than ever before,” said Bret Sewell, SVP and general manager of the Rambus Security Division.

451 Research principal analyst, Jordan McKee notes, “Digital has paved the way for fast and easy payment experiences, prompting a rise in account-based transactions. Fraudsters have made note of this trend and are increasing their focus on account credentials given their growing disbursement across many locations, including e-commerce websites, mobile and P2P wallets, invoices and payroll. To protect customers and thwart fraudulent attacks, businesses must implement security tactics that serve to eliminate the use of sensitive credentials in the transaction flow.”

Managing account data, faster and safer

The introduction of real-time payments increases risk for financial institutions, as they now have seconds instead of days to identify fraudulent transactions. By removing account numbers from the transaction process completely, tokenization can significantly reduce the risk and impact of account-based fraud and create secure real-time payments frameworks.

Key features of Rambus Payment Account Tokenization

The Payment Account Tokenization solution consists of a number of primary features, including:

- Account-based tokenization eliminates the need to store and transmit sensitive account information, alleviating the risk of stolen credentials being used to commit transactional fraud. The system integrates with existing infrastructure and tokens route normally through the payment network.

- Life cycle management enables banks to link, suspend, (re)activate or unlink tokenized bank account numbers.

- Domain controls limit token usage to a specific channel, merchant or spending limit by applying a set of parameters. Any use of the intercepted token outside of its set parameters would immediately flag as fraudulent and render the token useless.

- Cryptogram protection generates application cryptograms prior to a payment and validates them during a transaction. A cryptogram is a fingerprint of the transaction, holding elements of the originator, recipient, financial institution and the transaction.

- A token vault is a secured repository, or database, that establishes and maintains the payment token to Sending/Receiving Account number mapping. The token vault is the only area in which the token can be mapped back to the consumer’s original card details. All token vaults comply with Payment Card Industry (PCI) specifications.

For more information on the Rambus Payment Account Tokenization solution, visit rambus.com/pat.